Capital Gains Tax Rates 2024/5. A guide to capital gains tax (cgt) for individuals and entities with complex cgt obligations. There will be a 4 % reduction.

The capital gains tax allowance for the 2023/24 tax year has decreased by more than 50% from its 2022/23 threshold of £12,300 to £6,000.

After much speculation and pressure to increase capital gains tax (cgt) rates in recent budget announcements, the chancellor has today announced the surprise decision to reduce the top rate of cgt on residential property to 24%.

Tax Tables 2024 Irs For Capital Gains Vanda Miranda, Capital gains tax rates and annual exempt amounts. This means that any individual who makes gains on assets over the value of £6,000 annually will be required to pay capital gains tax on the excess amount at their marginal tax rate.

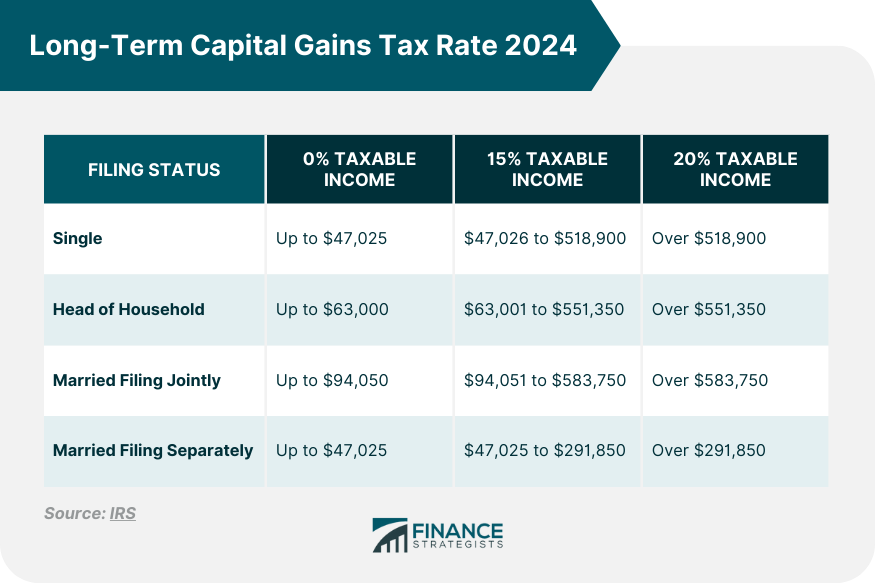

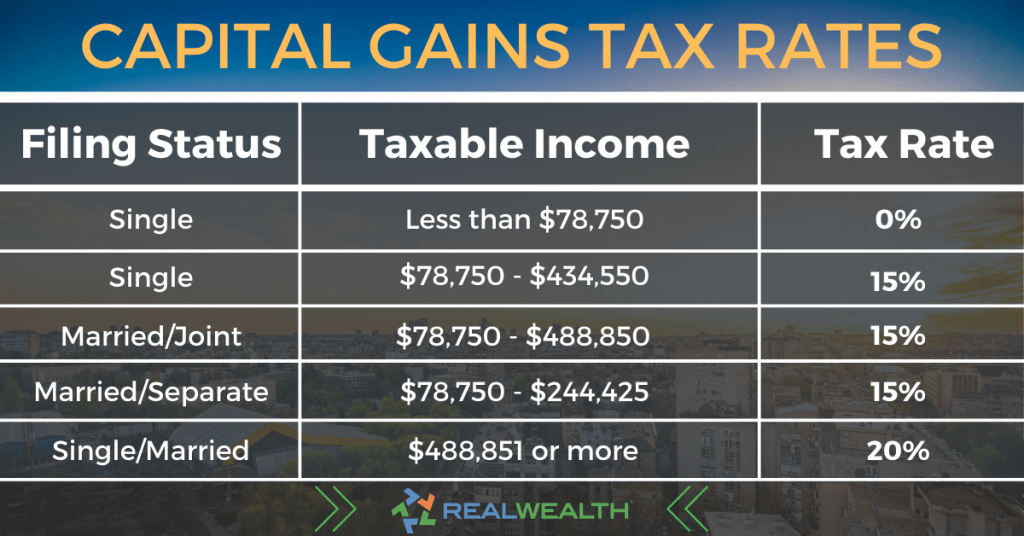

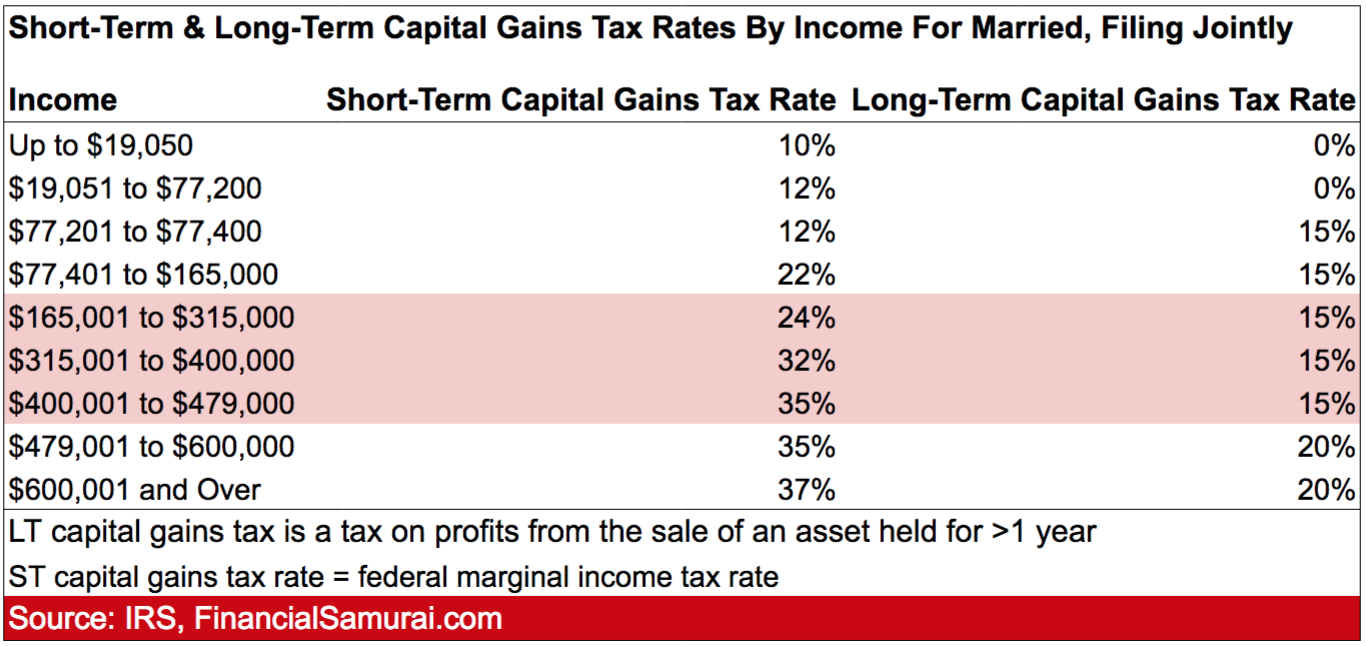

Short Term Capital Gains Tax 2024 Chart Clara Demetra, Instructions to complete the cgt schedule and tax return 2024. 2024 capital gains tax brackets.

Capital Gains Tax Rate 2024 Overview and Calculation, Capital gains taxes are due only. If you make a loss.

Capital Gains Tax 2024 Real Estate Calculator Vikky Jerrilyn, Based on the statement, capital gains tax (cgt) exemptions would undergo a reduction starting in april 2023, followed by additional decreases from april. Jason hollands, managing director at investing platform bestinvest, said:.

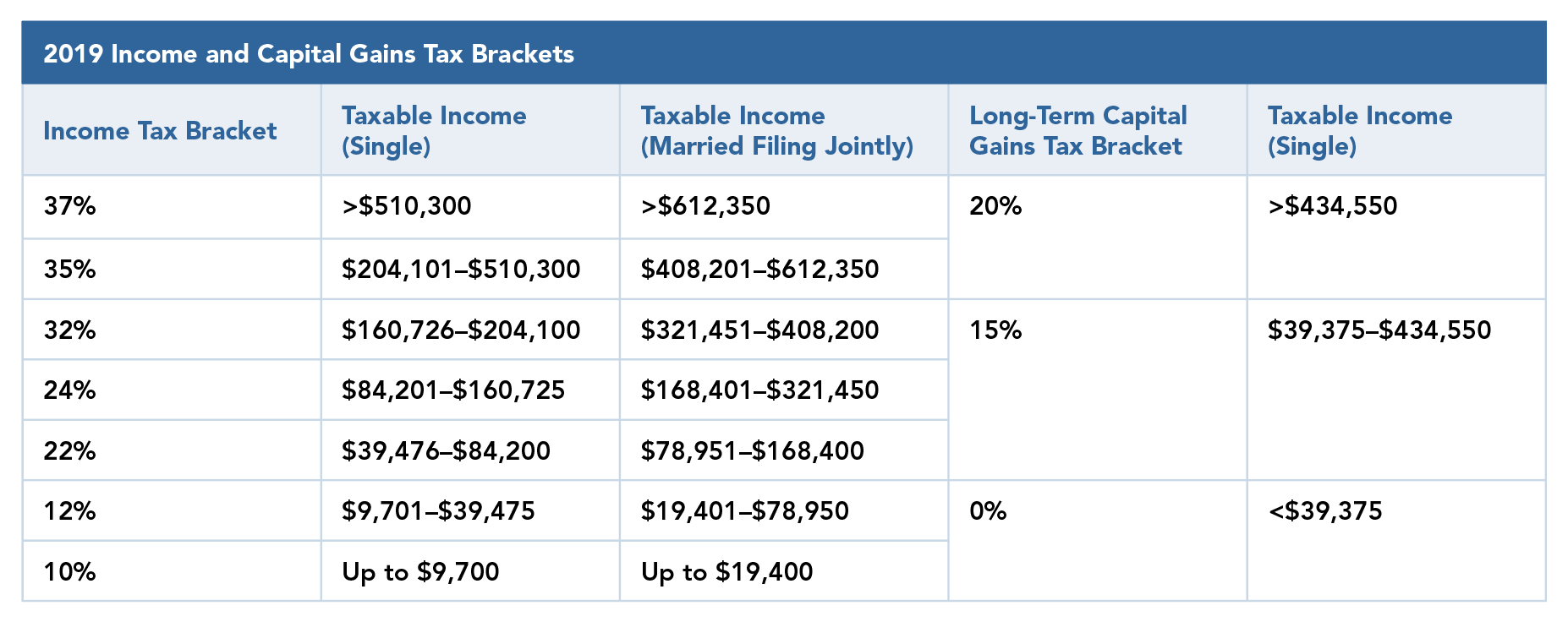

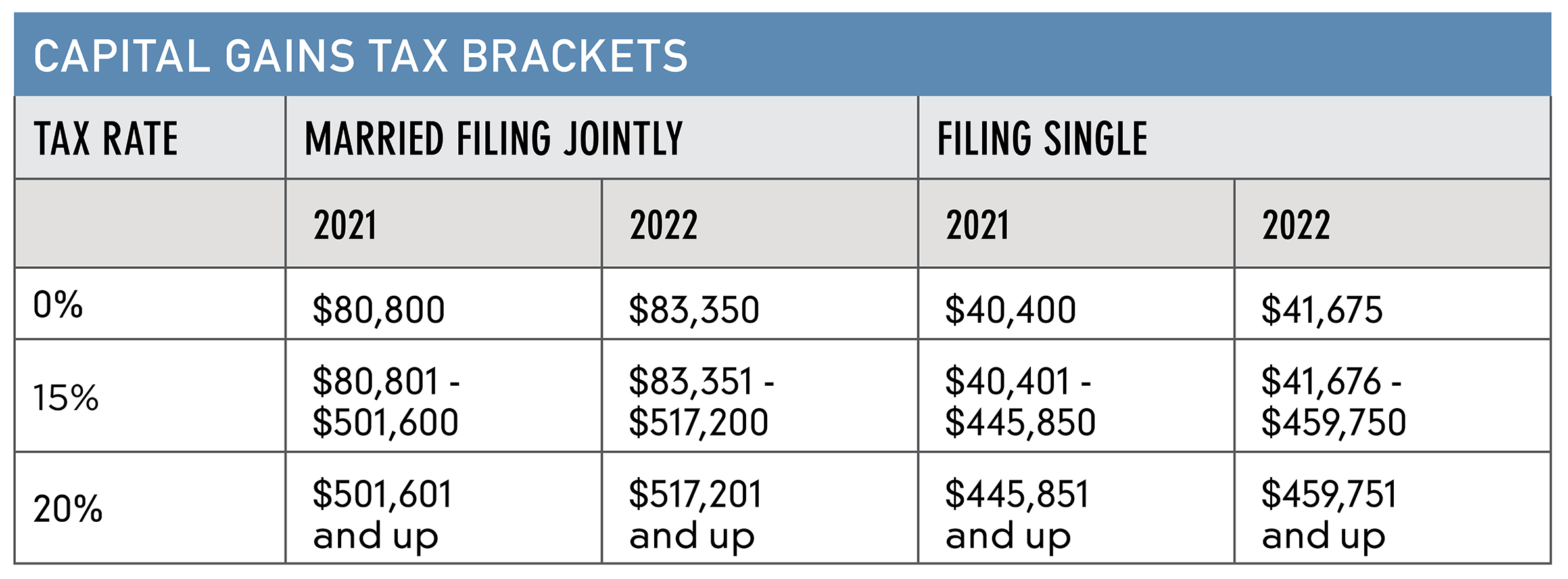

2024 Tax Brackets Chart Camel Olympie, In 2024, individuals' taxable income can be up to $47,025 to skip capital gains taxes with a 0% rate. Capital gains tax is a tax on the profit when you sell (or ‘dispose of’) something (an.

Irs Capital Gains Tax Rates 2024 Hannah Merridie, The capital gains tax allowance for the 2023/24 tax year has decreased by more than 50% from its 2022/23 threshold of £12,300 to £6,000. Frequently asked questions about making use of your capital gains tax allowances for 2024/25.

Capital Gains Tax Calculator 2024 Uk Elisha Chelsea, Enter the purchase and sale details of your assets along with tax reliefs and our capital gains tax calculator will work out your tax bill including all tax rates and allowances. Current capital gains tax rates are 18% and 20% (or 20% and 28% for property).

Capital Gains Rate 2024 Table Image to u, The capital gains tax allowance for the 2023/24 tax year has decreased by more than 50% from its 2022/23 threshold of £12,300 to £6,000. Individuals have an annual capital gains tax exemption of £3,000 (£6,000 2023/24).

2024 Long Term Capital Gains Tax Calculator Chris Delcine, Individuals have an annual capital gains tax exemption of £3,000 (£6,000 2023/24). After much speculation and pressure to increase capital gains tax (cgt) rates in recent budget announcements, the chancellor has today announced the surprise decision to reduce the top rate of cgt on residential property to 24%.

Capital Gains Tax Federal 2024 Amber Bettina, What is changing with capital gains tax in 2024? There are two main categories for capital gains:

The annual exemption allows chargeable gains up to £3,000 from 6 april 2024 (£6,000 2023/24) to be taken free of tax.